Scheduled Investment: A simple yet effective strategy

In the world of investing, scheduled investment (Dollar Cost Averaging – DCA) is a simple yet powerful strategy that can help investors mitigate market volatility and accumulate wealth over the long term. This strategy involves investing a fixed amount at regular intervals, regardless of market conditions, rather than investing a lump sum all at once.

Principles of Scheduled Investment

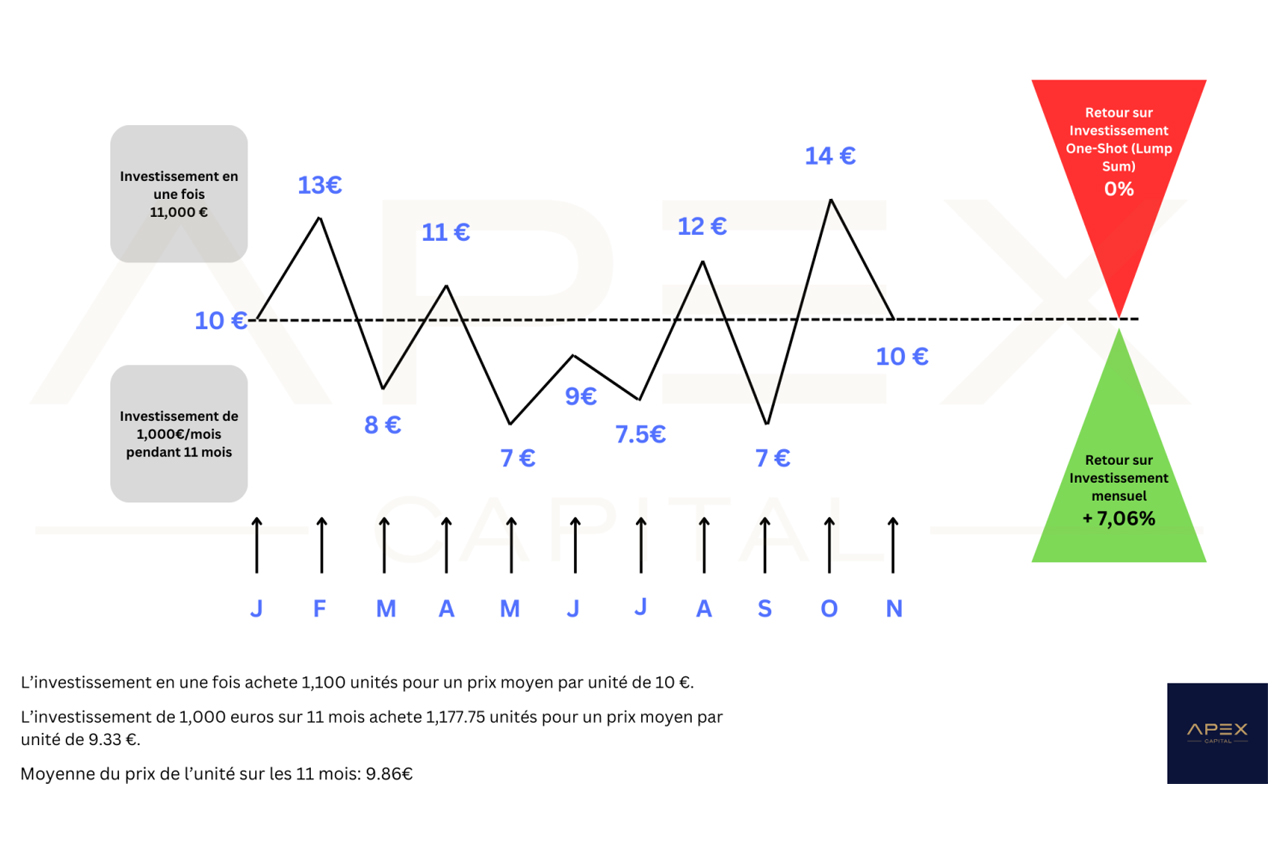

The fundamental principle of scheduled investment is that by investing a fixed amount periodically, you automatically buy more shares when prices are low and fewer shares when prices are high. This systematic approach helps smooth out the effects of market volatility and can potentially result in a lower average cost per share over the long term.

Here’s how it works:

1. Determine a Fixed Investment Amount and Interval: For example, €500 per month.

2. Invest the Predetermined Amount at the Chosen Interval: Whether the market is up or down.

3. Buy More Shares When Prices are Low: And fewer shares when prices are high.

4. Over Time: The average cost per share should be lower than the average market price during the investment period. (see illustration)

Advantages of Scheduled Investment

Scheduled investment offers several potential benefits for investors:

•Eliminates Emotions from Investing: By automating the investment process, DCA helps eliminate emotional biases that can often lead to poor investment decisions, such as buying when prices are high out of fear of missing out or selling when prices are low out of panic.

•Reduces Market Timing Risks: Scheduled investment eliminates the need to try to time the market, which is notoriously difficult and can lead to suboptimal investment decisions.

•Encourages Investment Discipline: Committing to a regular investment schedule promotes a disciplined approach to investing, crucial for long-term success.

•Potential for Lower Average Cost: Over time, consistently applying this strategy can potentially result in a lower average cost per share compared to lump-sum investing at the market peak.

•Gradual Exposure: For investors with a significant amount to invest, DCA allows for gradual market exposure, helping to mitigate the risk of investing a large sum at an inopportune time.

Implementing Scheduled Investment

Scheduled investment is a simple strategy that can be easily implemented through various investment vehicles, such as:

•Equity Savings Plans (PEA): This account allows for regular investments in stocks and other financial instruments while benefiting from tax advantages.

•Life Insurance: Life insurance contracts can include scheduled investment options, allowing for regular contributions to diversified funds.

•Retirement Savings Plans (PER): These plans offer the possibility of scheduling regular contributions to prepare for retirement while benefiting from tax advantages.

It is important to note that while scheduled investment can be an effective strategy, it does not guarantee profits and does not protect against losses. Additionally, there may be situations where lump-sum investing outperforms DCA, particularly in a continuously rising market.

Consistency and a long-term perspective are essential when implementing a scheduled investment strategy. By adhering to a regular investment schedule and allowing the power of compounding to work in your favor, DCA can be an invaluable tool for accumulating wealth over time.

Secure Your Future Today!

Contact Apex Capital Today

•Phone: 0784025701

•Email: contact@apexcapital.fr

Contactez nous

Contactez nous